If saving the most money is your goal, then the best way to get the cheapest auto insurance rates is to start doing a yearly price comparison from insurance carriers that insure vehicles in El Paso.

- Get a basic knowledge of how your policy works and the factors you can control to keep rates in check. Many things that result in higher rates like accidents, careless driving, and a not-so-good credit rating can be eliminated by making small lifestyle or driving habit changes. Read the full article for additional ideas to help find cheaper rates and find possible discounts that are available.

- Request price quotes from exclusive agents, independent agents, and direct providers. Direct and exclusive agents can only quote rates from a single company like Progressive and State Farm, while agents who are independent can quote prices from multiple companies.

- Compare the new rate quotes to the premium of your current policy to see if a cheaper price is available. If you find a better price and decide to switch, ensure coverage does not lapse between policies.

- Notify your agent or company to cancel the current policy and submit a signed application and payment for the new policy. As soon as coverage is bound, put the proof of insurance paperwork in an easily accessible location.

The most important part of shopping around is that you'll want to compare the same liability limits and deductibles on each quote and and to get prices from as many car insurance companies as possible. This guarantees a fair rate comparison and and a good selection of different prices.

Amazingly, a recent NerdWallet.com study showed that the vast majority of drivers have bought insurance from the same company for over three years, and nearly half have never even compared rates from other companies. Texas drivers could save roughly 70% each year by just shopping around, but they don't want to spend time to save money by comparing rate quotes.

Amazingly, a recent NerdWallet.com study showed that the vast majority of drivers have bought insurance from the same company for over three years, and nearly half have never even compared rates from other companies. Texas drivers could save roughly 70% each year by just shopping around, but they don't want to spend time to save money by comparing rate quotes.

If you have a current car insurance policy, you will be able to find the best rates using this information. Buying the cheapest car insurance in El Paso can initially seem challenging. Although Texas car owners must learn the way companies set your policy premium because rates are impacted by many factors.

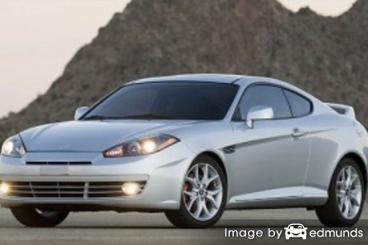

Companies offering Hyundai Tiburon insurance in Texas

The companies in the list below offer comparison quotes in El Paso, TX. If multiple companies are shown, we recommend you visit several of them to find the lowest car insurance rates.

Take advantage of these nine price cutting discounts

Not too many consumers would say insurance is affordable, but there are discounts available that can dramatically reduce your bill. Some trigger automatically at the time of quoting, but some must be asked for prior to getting the savings. If you are not receiving all the discounts you qualify for, you are paying more than you should be.

- Discounts for Cautious Drivers - Drivers who avoid accidents may receive a discount up to 45% than drivers with accidents.

- Fewer Miles Equal More Savings - Keeping the miles down on your Hyundai may enable drivers to earn lower premium rates on the low mileage vehicles.

- Seat Belts Save more than Lives - Drivers who always wear seat belts and also require passengers to buckle up could cut 10% or more off the personal injury premium cost.

- Policy Bundle Discount - When you have multiple policies with the same insurance company you may save up to 20% and get you inexpensive Hyundai Tiburon insurance in El Paso.

- Defensive Driver - Participating in a defensive driving class may get you a small discount and make you a better driver.

- Save with a New Car - Insuring a new Tiburon can be considerably cheaper because new model year vehicles have to meet stringent safety requirements.

- Good Student - Getting good grades can save 20 to 25%. Earning this discount can benefit you well after school through age 25.

- Online Discount - Certain insurance companies provide a small discount get El Paso car insurance on their website.

- Resident Student - Youth drivers who are attending college and don't have a car may qualify for this discount.

Discounts lower rates, but most of the big mark downs will not be given to the entire policy premium. Some only apply to individual premiums such as liability and collision coverage. So despite the fact that it appears adding up those discounts means a free policy, you aren't that lucky.

Some of the insurance companies who might offer most of the discounts above include:

If you need lower rates, check with every insurance company how you can save money. Some discounts may not apply to policies in El Paso. To see a list of insurance companies that can offer you the previously mentioned discounts in Texas, follow this link.

It's not one size fits all

When it comes to choosing coverage, there really is no one size fits all plan. Everyone's needs are different and a cookie cutter policy won't apply. For instance, these questions could help you determine whether your personal situation may require specific advice.

For instance, these questions could help you determine whether your personal situation may require specific advice.

- What if I total my Hyundai Tiburon and owe more than it's worth?

- What is UM/UIM insurance?

- Do I have ACV or replacement cost coverage?

- Do I have coverage for damage caused while driving under the influence?

- Do all my vehicles need collision coverage?

- Can good grades get a discount?

If you don't know the answers to these questions but you know they apply to you, you may need to chat with a licensed agent. To find an agent in your area, simply complete this short form or you can also visit this page to select a carrier

Comparing prices from local El Paso car insurance agents

Certain consumers just prefer to buy from a local agent and doing so can bring peace of mind The biggest benefit of getting free rate quotes online is the fact that you can find cheap car insurance rates and also buy local. And providing support for neighborhood insurance agencies is important especially in El Paso.

To make it easy to find an agent, after completing this quick form, your insurance data is emailed to agents in your area who want to provide quotes for your insurance coverage. You never need to contact any agents because prices are sent directly to your email. You can most likely find cheaper rates and a licensed agent to work with. If you need to compare rates from a specific car insurance provider, you can always find their quoting web page and complete a quote there.

What types of car insurance agents are in El Paso?

If you want to use a reputable agency, you must know there are a couple different types of agents and how they operate. Car insurance agencies are categorized either independent agents or exclusive agents.

Independent Car Insurance Agencies

Agents of this type can quote rates with many companies so as a result can place your coverage through many companies and find the cheapest rate. If they find a cheaper price, your policy is moved internally and you don't have to find a new agent.

If you need cheaper car insurance rates, we recommend you compare prices from several independent agencies in order to have the best price comparison.

Below is a short list of independent insurance agencies in El Paso that may be able to provide pricing information.

Tony Ramos Insurance

7230 Gateway Blvd E H - El Paso, TX 79915 - (915) 599-1678 - View Map

Colonial Insurance Agency

7636 Gateway Blvd E - El Paso, TX 79915 - (915) 592-0999 - View Map

American Agency Insurance

5959 Gateway Blvd W #533 - El Paso, TX 79925 - (915) 772-7766 - View Map

Exclusive Insurance Agencies

Agents that elect to be exclusive work for only one company such as Farmers Insurance and State Farm. These agents are unable to provide rate quotes from other companies so if the price isn't competitive there isn't much they can do. Exclusive agencies are well schooled on what they offer which aids in selling service over price.

Shown below is a list of exclusive agents in El Paso that can give you comparison quotes.

Jacobo Akle - State Farm Insurance Agent

6065 Montana Ave STE C1 - El Paso, TX 79925 - (915) 775-2553 - View Map

Tomas Casillas - State Farm Insurance Agent

1568 Joe Battle Blvd #104 - El Paso, TX 79936 - (915) 857-4959 - View Map

Mike Rosales - State Farm Insurance Agent

1831 N Zaragoza Rd #109 - El Paso, TX 79936 - (915) 921-0812 - View Map

Deciding on a insurance agency requires you to look at more than just a low price. Some important questions to ask are:

- What insurance companies do they work with in El Paso?

- Is coverage determined by price?

- If independent agents, which companies do they recommend?

- Will high miles depreciate repair valuations?

- How often do they review coverages?

- Can you use your own choice of collision repair facility?

- Are they actively involved in the community?

Insurance coverages explained

Understanding the coverages of your policy can help you determine the best coverages at the best deductibles and correct limits. Policy terminology can be difficult to understand and nobody wants to actually read their policy. Below you'll find the normal coverages available from insurance companies.

Collision coverage protection

Collision insurance covers damage to your Tiburon from colliding with another vehicle or an object, but not an animal. You have to pay a deductible then your collision coverage will kick in.

Collision insurance covers claims such as colliding with a tree, hitting a mailbox, rolling your car and scraping a guard rail. Paying for collision coverage can be pricey, so analyze the benefit of dropping coverage from vehicles that are 8 years or older. Another option is to bump up the deductible on your Tiburon to bring the cost down.

Coverage for liability

This can cover damages or injuries you inflict on people or other property in an accident. Split limit liability has three limits of coverage: bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. You might see values of 30/60/25 which means $30,000 bodily injury coverage, a limit of $60,000 in injury protection per accident, and $25,000 of coverage for damaged property. Another option is one limit called combined single limit (CSL) that pays claims from the same limit with no separate limits for injury or property damage.

Liability coverage pays for things like bail bonds, funeral expenses and repair costs for stationary objects. How much liability coverage do you need? That is a personal decision, but consider buying as much as you can afford. Texas requires drivers to carry at least 30/60/25 but it's recommended drivers buy better liability coverage.

The chart below shows why minimum state limits may not be enough coverage.

Med pay and Personal Injury Protection (PIP)

Med pay and PIP coverage kick in for short-term medical expenses for things like rehabilitation expenses, dental work, surgery and X-ray expenses. They are used in conjunction with a health insurance policy or if there is no health insurance coverage. It covers all vehicle occupants and also covers if you are hit as a while walking down the street. PIP is only offered in select states and may carry a deductible

Comprehensive insurance

Comprehensive insurance pays for damage OTHER than collision with another vehicle or object. A deductible will apply and then insurance will cover the rest of the damage.

Comprehensive coverage pays for claims like hitting a bird, rock chips in glass, theft and a broken windshield. The highest amount you'll receive from a claim is the market value of your vehicle, so if your deductible is as high as the vehicle's value it's not worth carrying full coverage.

Uninsured/Underinsured Motorist (UM/UIM)

Uninsured or Underinsured Motorist coverage gives you protection when the "other guys" are uninsured or don't have enough coverage. Covered claims include injuries sustained by your vehicle's occupants as well as damage to your Hyundai Tiburon.

Since many Texas drivers only carry the minimum required liability limits (Texas limits are 30/60/25), it doesn't take a major accident to exceed their coverage limits. For this reason, having high UM/UIM coverages is a good idea. Most of the time these coverages are similar to your liability insurance amounts.

El Paso auto insurance company ratings

Choosing the right company is difficult considering how many choices you have in Texas. The company information shown next may help you choose which insurers you want to consider purchasing coverage from.

Top 10 El Paso Car Insurance Companies by A.M. Best Rank

- Travelers - A++

- USAA - A++

- GEICO - A++

- State Farm - A++

- Titan Insurance - A+

- Esurance - A+

- Progressive - A+

- The Hartford - A+

- Allstate - A+

- Nationwide - A+

Top 10 El Paso Car Insurance Companies Ranked by Customer Satisfaction

- USAA - 91%

- AAA Insurance - 90%

- Esurance - 90%

- Mercury Insurance - 89%

- Nationwide - 89%

- Travelers - 88%

- Progressive - 88%

- Safeco Insurance - 88%

- State Farm - 88%

- Allstate - 88%

Cheaper coverage is out there

Throughout this article, we presented a lot of techniques to find cheaper Hyundai Tiburon insurance in El Paso. The key thing to remember is the more you quote El Paso car insurance, the better chance you'll have of finding low cost El Paso car insurance quotes. Drivers may even discover the lowest prices come from a company that doesn't do a lot of advertising. Some small companies often have lower rates on specific markets than the large multi-state companies such as Progressive or GEICO.

Discount Hyundai Tiburon insurance in El Paso can be sourced on the web and with local El Paso insurance agents, and you need to price shop both in order to have the best price selection to choose from. A few companies may not offer internet price quotes and usually these smaller companies prefer to sell through independent insurance agencies.

Helpful resources

- Older Driver Statistics (Insurance Information Institute)

- Credit Impacts Car Insurance Rates (State Farm)

- Senior Drivers (Insurance Information Institute)