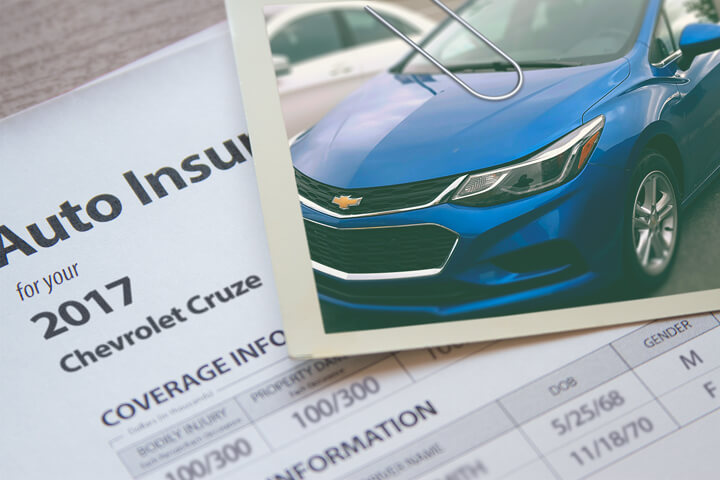

Chevy Cruze insurance rates image courtesy of QuoteInspector.com

To save the most money, the best way to get more affordable car insurance rates is to make a habit of regularly comparing prices from companies in El Paso.

To save the most money, the best way to get more affordable car insurance rates is to make a habit of regularly comparing prices from companies in El Paso.

- First, take a little time to learn about the different coverages in a policy and the measures you can take to keep rates low. Many things that increase rates like accidents, traffic tickets, and a substandard credit history can be eliminated by making lifestyle changes or driving safer.

- Second, obtain price quotes from exclusive agents, independent agents, and direct providers. Direct and exclusive agents can only give prices from one company like Progressive or Allstate, while independent agencies can provide prices for many different companies.

- Third, compare the new quotes to your existing rates to see if cheaper Cruze coverage is available. If you find better rates and decide to switch, ensure coverage does not lapse between policies.

The key thing to remember is to try to use the same amount of coverage on each quote and and to analyze every insurance company. Doing this guarantees a level playing field and plenty of rates choose from.

Unimaginable but true, the vast majority of consumers have bought car insurance from the same company for four years or more, and roughly 40% of drivers have never even compared quotes to find affordable rates. Many drivers in Texas can save 70% each year just by getting comparison quotes, but they underestimate the actual amount they would save if they just switched companies.

Buying the cheapest protection in El Paso is not that difficult. If you already have coverage or just want to reduce your rates, use these cost-cutting techniques to get lower rates while maintaining coverages. Shoppers just need to learn the fastest way to get comparison quotes from many companies at once.

The cheapest El Paso Chevy Cruze insurance

The companies in the list below are our best choices to provide free quotes in Texas. If multiple providers are shown, we suggest you click on several of them to get the best price comparison.

Lower rates by qualifying for discounts

Insuring your vehicles can cost a lot, but companies offer discounts that you may not even be aware of. Certain discounts will be triggered automatically at the time of purchase, but some discounts are required to be manually applied before being credited.

- No Claim Discounts - Insureds who avoid accidents and claims pay less as opposed to accident-prone drivers.

- Paperwork-free - A handful of insurance companies will give a small break just for signing your application on the web.

- Auto/Life Discount - Select insurance companies reward you with a break if you buy a life policy as well.

- Drive Less and Save - Low annual miles could be rewarded with lower insurance rates due to less chance of an accident.

- Senior Citizen Rates - Drivers over the age of 55 may be able to get reduced rates.

- Driver Safety - Participating in a course in defensive driving can save you 5% or more and make you a better driver.

- Discount for Good Grades - Being a good student may save as much as 25% on a El Paso car insurance quote. Earning this discount can benefit you up to age 25.

Don't be shocked that some of the credits will not apply to the entire policy premium. Most only cut specific coverage prices like liability, collision or medical payments. Just because it seems like it's possible to get free car insurance, it just doesn't work that way.

If you would like to choose from a list of insurance companies who offer free Chevy Cruze insurance quotes in Texas, click here to view.

Car insurance is not optional

Despite the high cost, insuring your vehicle serves an important purpose.

- Almost all states have compulsory liability insurance requirements which means it is punishable by state law to not carry a specific level of liability protection if you don't want to risk a ticket. In Texas these limits are 30/60/25 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If your Cruze has a lienholder, almost all lenders will stipulate that you have full coverage to guarantee loan repayment. If you do not pay your insurance premiums, the lender may insure your Chevy for a much higher rate and make you pay for the expensive policy.

- Car insurance protects not only your Chevy but also your financial assets. It will also provide coverage for hospital and medical expenses for you, your passengers, and anyone else injured in an accident. Liability coverage, the one required by state law, also covers legal expenses in the event you are sued. If you have damage to your Chevy as the result of the weather or an accident, collision and comprehensive (also known as other-than-collision) coverage will pay to have it repaired.

The benefits of insuring your car more than offset the price you pay, especially if you ever need it. Today the average American driver is overpaying over $825 a year so it's important to compare rates each time the policy renews to be sure current rates are still competitive.

Texas auto insurance companies

Choosing the right insurance provider can be challenging considering how many different companies sell coverage in El Paso. The company rank data displayed below can help you pick which car insurance providers you want to consider comparing price quotes from.

Top 10 El Paso Car Insurance Companies by A.M. Best Rank

- Travelers - A++

- USAA - A++

- GEICO - A++

- State Farm - A++

- Titan Insurance - A+

- Esurance - A+

- Progressive - A+

- The Hartford - A+

- Allstate - A+

- Nationwide - A+

Top 10 El Paso Car Insurance Companies Ranked by Customer Satisfaction

- USAA - 91%

- AAA Insurance - 90%

- Esurance - 90%

- Mercury Insurance - 89%

- Nationwide - 89%

- Travelers - 88%

- Progressive - 88%

- Safeco Insurance - 88%

- State Farm - 88%

- Allstate - 88%

When in doubt talk to an agent

Keep in mind that when it comes to choosing the right insurance coverage for your vehicles, there really isn't a one-size-fits-all type of policy. You are unique.

For instance, these questions may help you determine whether your personal situation would benefit from professional advice.

- Is borrowed equipment or tools covered if stolen or damaged?

- What does UM/UIM cover?

- Does my policy cover me when driving someone else's vehicle?

- Does my policy pay for OEM or aftermarket parts?

- Can my teen driver be rated on a liability-only vehicle?

- Should I buy full coverage?

- Are my friends covered when driving my Chevy Cruze?

- Why am I required to buy high-risk coverage?

If you don't know the answers to these questions, then you may want to think about talking to a licensed insurance agent. If you want to speak to an agent in your area, complete this form. It is quick, free and you can get the answers you need.

Local El Paso insurance agents

Many people would rather buy from a licensed agent and we recommend doing that Good insurance agents are very good at helping people manage risk and help in the event of a claim. One of the best bonuses of comparing insurance online is that you can obtain cheap rate quotes and still have an agent to talk to. Buying from and supporting local agents is definitely important in El Paso.

Upon completion of this simple form, your insurance data is instantly submitted to local insurance agents in El Paso who will return price quotes for your insurance coverage. There is no need to contact any insurance agencies since price quotes are sent immediately to you. If you have a need to compare prices from one company in particular, you would need to search and find their rate quote page to submit a rate quote request.

Upon completion of this simple form, your insurance data is instantly submitted to local insurance agents in El Paso who will return price quotes for your insurance coverage. There is no need to contact any insurance agencies since price quotes are sent immediately to you. If you have a need to compare prices from one company in particular, you would need to search and find their rate quote page to submit a rate quote request.

If you are wanting to find an insurance agent, it helps to know the two types of agencies and how they work. Agents can either be exclusive or independent. Either one can handle insurance, but we need to point out the subtle differences because it can influence the kind of agent you use.

Independent Insurance Agents

Independent agents are not required to write business for one company so as a result can place your coverage with a variety of different insurance companies and get the cheapest rates. If prices rise, your agent can just switch to a different company and you don't have to find a new agent. If you are trying to find cheaper rates, it's a good idea to get some free quotes from multiple independent agents in order to compare the most rates.

The following are El Paso independent agencies that can possibly get you free price quotes.

Nationwide Insurance: Ed Flores Insurance Agency Inc

1400 N Zaragoza Rd e - El Paso, TX 79936 - (915) 857-3300 - View Map

Rey Estrada Insurance

6999 Montana Ave - El Paso, TX 79925 - (915) 771-9193 - View Map

Red Rock Insurance Agency

9109 Dyer St f - El Paso, TX 79924 - (915) 759-9000 - View Map

Exclusive Insurance Agents

These type of agents have only one company to place business with such as American Family, State Farm, and Allstate. They are unable to compare other company's rates so they have no alternatives for high prices. Exclusive agencies are well schooled on the products they sell and that can be a competitive advantage.

Below are exclusive agencies in El Paso that are able to give price quotes.

Yvonne Curtis - State Farm Insurance Agent

1550 Hawkins Blvd Ste 15 - El Paso, TX 79925 - (915) 591-0871 - View Map

Carlos Robles - State Farm Insurance Agent

12025 Rojas Dr Ste E - El Paso, TX 79936 - (915) 856-7758 - View Map

Eric Fierro - State Farm Insurance Agent

2200 N Yarbrough Dr c - El Paso, TX 79925 - (915) 595-3622 - View Map

Finding the right car insurance agent needs to be determined by more than just a cheap price quote. Get answers to these questions too.

- Did they already check your driving record and credit reports?

- What are their preferred companies if they are an independent agency?

- Do they specialize in personal lines coverage in El Paso?

- Is the agent CPCU or CIC certified?

- Will you be dealing directly with the agent or with a Custom Service Representative (CSR)?