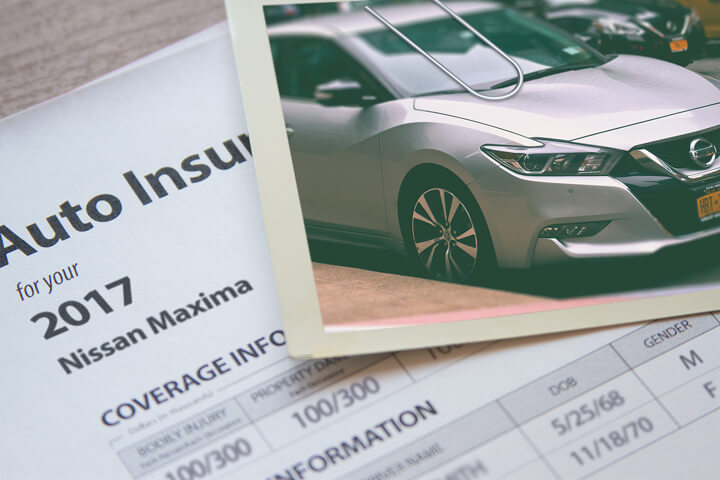

Nissan Maxima insurance rates image courtesy of QuoteInspector.com

The easiest way to get discount Nissan Maxima insurance in El Paso is to start comparing prices yearly from different companies who provide car insurance in Texas. Rate comparisons can be done by following these steps.

First, it will benefit you to learn about car insurance and the things you can change to lower rates. Many things that result in higher rates such as traffic citations and a not-so-good credit history can be improved by being financially responsible and driving safely. Later in this article we will cover additional tips to help prevent expensive coverage and get bigger discounts that may have been overlooked.

Second, compare rates from direct, independent, and exclusive agents. Direct and exclusive agents can only give prices from one company like GEICO or Allstate, while independent agencies can give you price quotes from multiple insurance companies. Begin your rate comparison

Third, compare the price quotes to your current policy premium to see if a cheaper rate is available. If you can save money, make sure coverage is continuous and does not lapse.

One bit of advice is that you'll want to make sure you compare identical limits and deductibles on every quote and and to get rate quotes from as many companies as you can. This enables a fair price comparison and the best price selection.

Amazingly, most auto insurance buyers in Texas kept buying from the same company for at least the last four years, and nearly the majority have never quoted rates to find cheap coverage. With the average auto insurance premium being $1,847, American drivers can save as much as $860 each year by just comparing quotes, but they mistakenly think it's difficult to compare rates and save money.

Amazingly, most auto insurance buyers in Texas kept buying from the same company for at least the last four years, and nearly the majority have never quoted rates to find cheap coverage. With the average auto insurance premium being $1,847, American drivers can save as much as $860 each year by just comparing quotes, but they mistakenly think it's difficult to compare rates and save money.

If you have car insurance now, you will definitely be able to reduce the price you pay using the concepts covered in this article. We hope to instruct you on the best way to buy inexpensive car insurance and some tips to save money. But Texas car owners must know the way companies sell insurance online because it varies considerably.

Keep in mind that more quotes increases your odds of finding lower pricing. Not every company does rate quotes online, so it's important to compare prices on coverage from those companies, too.

The car insurance companies shown below have been selected to offer quotes in Texas. If several companies are displayed, it's a good idea that you visit as many as you can to find the most affordable car insurance rates.

Insurance rate breakdown

The table below outlines estimates of insurance coverage prices for Nissan Maxima models. Learning a little about how insurance quotes are figured can help customers make smart choices when purchasing an insurance policy.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Maxima 3.5 S | $362 | $672 | $462 | $28 | $138 | $1,662 | $139 |

| Maxima 3.5 SV | $362 | $774 | $462 | $28 | $138 | $1,764 | $147 |

| Get Your Own Custom Quote Go | |||||||

Prices above based on single male driver age 40, no speeding tickets, no at-fault accidents, $250 deductibles, and Texas minimum liability limits. Discounts applied include claim-free, multi-policy, safe-driver, multi-vehicle, and homeowner. Price estimates do not factor in the specific area where the vehicle is garaged which can influence price quotes substantially.

Higher deductibles lower rates

One frequently asked question is how low should you set your deductibles. The following tables may help to illustrate the rate fluctuation when you choose different physical damage deductibles. The first set of prices uses a $100 deductible for comp and collision and the second pricing table uses a $1,000 deductible.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Maxima 3.5 S | $412 | $698 | $382 | $22 | $114 | $1,653 | $138 |

| Maxima 3.5 SV | $412 | $804 | $382 | $22 | $114 | $1,759 | $147 |

| Get Your Own Custom Quote Go | |||||||

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Maxima 3.5 S | $228 | $368 | $382 | $22 | $114 | $1,114 | $93 |

| Maxima 3.5 SV | $228 | $424 | $382 | $22 | $114 | $1,170 | $98 |

| Get Your Own Custom Quote Go | |||||||

Table data assumes married male driver age 30, no speeding tickets, no at-fault accidents, and Texas minimum liability limits. Discounts applied include multi-vehicle, homeowner, multi-policy, claim-free, and safe-driver. Premium amounts do not factor in specific location information which can impact coverage prices noticeably.

Based on this data, using a $100 deductible costs an average of $47 more each month or $564 each year than buying the higher $1,000 deductible. Because you would be required to pay $900 more to settle a claim with a $1,000 deductible as compared to a $100 deductible, if you usually have more than 19 months between claims, you would probably be better off if you opt for a higher deductible.

Informed Consumers Can Lower Insurance Rates

One of the most helpful ways to save on insurance is to to have a grasp of some of the things that play a part in calculating your premiums. If you understand what positively or negatively impacts your premiums, this allows you to make good choices that may reward you with lower premium levels.

- Filing claims can cost you more - Companies in Texas award discounts to insureds that do not abuse their auto insurance. If you frequently file small claims, you can look forward to higher rates. Insurance coverage is designed for larger claims.

Is auto insurance cheaper for women or men? - Over the last 50 years, statistics have shown that women are safer drivers than men. However, don't assume that men are worse drivers. Males and females cause accidents in similar numbers, but the males tend to have higher claims. Men also statistically receive more major tickets like driving under the influence (DUI).

The example below shows the difference between Nissan Maxima yearly insurance costs for male and female drivers. The rate quotes are based on no claims, a clean driving record, comprehensive and collision coverage, $500 deductibles, single status, and no discounts are factored in.

- Proper usage rating affects costs - The higher the mileage driven annually the more it will cost to insure it. Almost all companies price each vehicle's coverage based on their usage. Vehicles left parked in the garage can get a lower rate than cars that get driven a lot. Incorrect rating for your Maxima may be costing you higher rates. It's always a good idea to double check that your policy is showing the correct driver usage.

- Never allow your insurance to lapse - Driving with no insurance can get you a ticket and your next policy will cost more because you let your coverage lapse. Not only will you pay higher rates, the inability to provide proof of insurance can result in a fine, jail time, or a revoked license. You may have to provide proof of insurance in the form of an SR-22 filing with the Texas motor vehicle department.

- Urban residents pay more - Being located in smaller towns and rural areas of the country has it's advantages when trying to find low car insurance rates. Fewer people means reduced accidents. City drivers have to deal with more auto accidents and higher rates of accident claims. The longer drive time means more chance of being in an accident.

Auto insurance is an important decision

Even though El Paso Maxima insurance rates can get expensive, auto insurance is not optional due to several reasons.

First, the majority of states have mandatory liability insurance requirements which means the state requires a specific level of liability coverage in order to drive the car. In Texas these limits are 30/60/25 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

Second, if your car has a lienholder, most lenders will require you to buy insurance to guarantee payment of the loan. If you let the policy lapse, the bank may buy a policy for your Nissan at a more expensive rate and require you to reimburse them for the expensive policy.

Third, auto insurance protects both your Nissan Maxima and your assets. It will also cover medical transport and hospital expenses for you, any passengers, and anyone injured in an accident. Liability coverage also pays for attorney fees and expenses if someone files suit against you as the result of an accident. If damage is caused by hail or an accident, collision and comprehensive coverages will pay all costs to repair after the deductible has been paid.

The benefits of carrying enough insurance greatly outweigh the cost, especially for larger claims. But the average driver in Texas overpays more than $830 a year so smart consumers compare quotes each time the policy renews to ensure rates are competitive.